Welcome to Harris County Emergency Services District No. 12 Fire Department

Learn about Harris County ESD 12.

Learn about the Fire Department.

Latest News

Accepting Applications for Full-Time Drivers and Captains

Apply Now!

Application Deadline April 19, 2024

Accepting Applications for the 2024 Second Quarter 3-Week Orientation Training

Drivers – Annual Starting Pay $68,377.50 Up To $74,455.50 After One Year

Captains – Annual Starting Pay $75,975 Up To $82,053 After One Year

CLICK ON THE JOB OPPORTUNITIES TAB FOR APPLICATION INSTRUCTIONS AND JOB INFORMATION

CLICK ON THE APPLICATION TAB TO COMPLETE AN APPLICATION

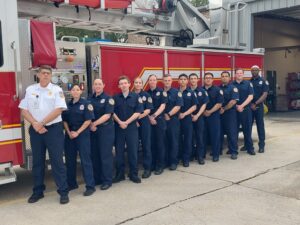

New Firefighters Complete Orientation Training

On February 9, 2024, twelve new Firefighters successfully completed three 50-hour grueling weeks of Orientation Training that consisted of daily physical fitness training, policy and procedure training, firefighting skills training, and team building skills training.

The Department appreciates the participation of Harris County ESD 12 Officers, Engineers (Drivers), and Firefighters for their efforts and dedication to provide the new Firefighters with realistic and challenging training.

The Department is proud of the new Firefighter efforts and commitment to be part of the “Best of the Best” ISO Class 1 Fire Department.

Lucie “The Stop-Drop-Roll Dalmatian” Makes A Suprise Visit to Sam Houston Elementary School

On Friday February 9, 2024, Lucie the “Stop Drop and Roll Dalmatian and Fire Chief Edward Russell made a surprise visit to GPISD Sam Houston Elementary School. Lucie helped the Engine 24 crew (Captain Brian Bunnell, Captain Lavell Warren, Engineer Eric Jacot, Firefighter Daelon Johnson and Firefighter Gabriela Ramos present multiple Fire Safety Education programs to students and instructors.

Lucie the “Stop Drop and Roll Dalmatian, is AKC registered, has been professionally trained, and has all required vaccinations.

Twelve New Firefighters Complete Live Fire Training

Harris County Fire Mashal’s Office Fire Training Center, Lieutenant Jason Barnes (far right end of photo) – welcomes Harris County ESD 12 Fire Department’s, twelve new Firefighters, one existing Firefighter, one Engineer (Driver), three Captains and three District Chiefs to the Fire Training Center

On Thursday February 8, 2024, twelve new Firefighters successfully completed their live fire training scenarios at the Harris County Fire Marshals Office Fire Training Center. The twelve new Firefighters attended two full days of live fire training during their 3-week Orientation Training Program.

The years of cooperative partnering between Harris County ESD 12 Fire Department and the Harris County Fire Marshal’s Office for use of the Training Center, continues to strengthen the ability to provide the Department quality Firefighters.

Department Welcomes Twelve New Firefighters

Twelve new Firefighters began the Department’s 3-week orientation training program on January 22, 2024. The Program covers Department policies, procedures, repetitive firefighter skill applications, and live fire training. The new Firefighters will be assigned to a shift beginning on February 13, 2024.